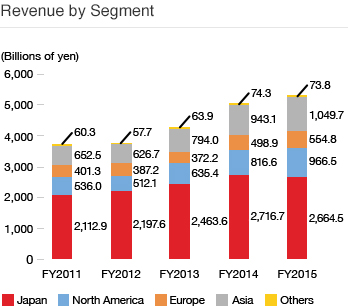

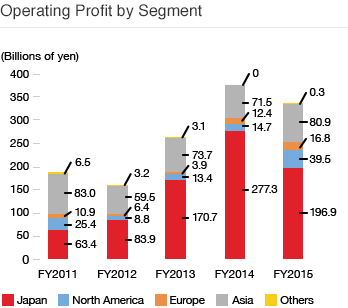

Figures for the fiscal 2014, the year ended March 31, 2014, and afterwards are based on International Financial Reporting Standards (IFRS).

(Figures for the fiscal 2013, the year ended March 31, 2013, and prior are based on Japanese accounting standards.)

open

![]()

In the domestic automobile market, revenue decreased 1.9% year on year, to ¥2,664.5 billion. This decline was largely attributable to a shift toward compact vehicles for the domestic market and lower sales of products for use overseas. Similarly, operating profit was down 29.0%, to ¥196.9 billion, due to detractors including the lower capacity utilization rate that followed reduced sales as well as an increase in labor costs and other fixed costs.

![]()

The Japanese economy is anticipated to display a modest recovery trend on the back of increased exports and capital expenditure. These increases will follow from the dissipation of the adverse impact of the consumption tax rate hike as well as the benefits of the depreciated yen and lower crude oil prices. In the domestic automobile market, however, conditions are expected to deteriorate in comparison to fiscal 2015 due to a delayed recovery as well as a sales downturn due to the increase in taxes for compact vehicles.

Against this backdrop, the Company will install 1/N production equipment and lines to create DANTOTSU plants with the aim of realizing increases in investment efficiency and productivity in terms of human resources, facilities, and plant floor space. When introducing the new lines, we will employ designs similar to previous lines to lower installation costs and start-up costs. At the same time, development will be advanced while optimally allocating our resources by shifting focus toward growth fields, such as active safety systems. By increasing production and development efficiency in this manner, we will endeavor to build a business structure that can maintain stable profit levels, even in a sluggish market.

open

![]()

The U.S. automobile market showed strong sales and production levels due to recovery in the U.S. economy. In this market, revenue rose 18.4% year on year, to ¥966.5 billion, following increases in the number of automobiles produced for Toyota Motor Corporation and Honda Motor Co., Ltd., as well as the benefit of sales promotions for heating, ventilation, and air-conditioning (HVAC) units and gasoline direct injection engine products. Buoyed by the benefits of a higher capacity utilization rate stemming from increased sales, operating profit grew 156.9%, to ¥39.5 billion.

![]()

In the United States, despite the decrease in exports and rise in interest rates resulting from the strong U.S. dollar, the economy is expected to continue to expand gradually, supported by the stable job market and low crude oil prices. The automobile market is likewise forecast to grow steadily.

In this environment, the Company will expand plants in Mexico to establish an optimal production and supply system for all of North America and thereby respond to the expected increases in automobile production going forward. In addition, we will enhance human resource development programs for production, maintenance, and other manufacturing-related personnel based on the recognition that these employees are essential to ensuring stable operations and the smooth start-up of new facilities. Through these efforts, we will reinforce DENSO's earnings structure. In the area of R&D, collaboration will be pursued with technical centers and external partners to enhance development capabilities related to advanced driving support, which is in high demand in North America.

open

![]()

In Europe, market recovery coupled with the success of sales promotions for HVAC units and diesel common rail systems led revenue to increase 11.2% year on year, to ¥554.8 billion. Operating profit rose 39.6%, to ¥16.8 billion, due to such factors as gains from a capacity utilization rate increase brought about by the sales increase.

![]()

The European economy is set to recover gradually as a result of improvements in consumer spending, corporate expenditures, and exports stemming from the benefits of quantitative easing, lower crude oil prices, currency devaluation, and a strong job market. The automobile market, too, will recover steadily leading up to 2018.

Under these conditions, we will continue to advance sales promotions for powertrain control systems and thermal systems aimed primarily at European customers. In manufacturing operations, we will strive to construct a more competitive production system by further accelerating the shift toward local production of parts and equipment and developing optimal processes that incorporate suppliers. In terms of development, the European market is highly demanding as it is on the forefront of environmental and safety regulations. Accordingly, DENSO will strengthen its design functions to create products that meet the needs of customers in this market.

open

![]()

While growth slowed in Thailand and Indonesia, automobile production rose centered on China. As a result, revenue was up 11.3% year on year, to ¥1,049.7 billion. While there was an increase in labor costs and expenses for setting up new factories and technical centers to fuel future growth, this was outweighed by the gains on capacity utilization following higher sales and the currency exchange gain stemming from yen depreciation. Accordingly, operating profit increased 13.1%, to ¥80.9 billion.

![]()

Countries in the ASEAN region continue to suffer from sluggish internal demand, and economic growth is therefore forecast to be limited to a slow pace. Nonetheless, this region is anticipated to see ongoing economic growth over the medium to long term. Meanwhile, there is a certain degree of uncertainty with regard to the future of the automobile market. However, the market on the whole is expected to expand steadily going forward.

In this environment, we will continue to promote sales of compact vehicles by our cost competitive products. At the same time, we will work to differentiate the Company's offerings by launching products with specifications that optimally address the issues faced by each market in response to the introduction of regulations related to the fields of environment and safety. In the environment field, we will step up activities aimed at creating markets for stop/start systems and energy-efficient air-conditioning systems. In the safety field, we will focus on promoting sales of airbags while also advancing preparations for future promotions of cutting-edge safety products.