CFO MESSAGE

Enhancing Our Ability to Continuously Create Corporate Value

through Successful Implementation of Financial Strategies

Yasushi Matsui : CFO(Chief Financial Officer) Member of the Board of Directors, Senior Executive Officer

Pursuit of Growth and Corporate Value Creation

In fiscal 2022, consolidated revenue rose 11.7% year on year, to a new record high of ¥5,515.5 billion, and operating profit was up 120.0%, to ¥341.2 billion. Factors behind this strong performance included the recovery of sales from the impacts of the COVID-19 pandemic, the benefits of sales promotions for electrified and ADAS products, and profitability improvements achieved through efforts to reform our profit structure advanced under “Reborn21.” These factors outweighed the detractions from adverse operating environment trends including a drop in automobile production in the wake of global semiconductor shortages and higher prices for electronic and other components, logistics, materials, and energy.

We expect to continue to face a challenging operating environment in fiscal 2023 in the midst of semiconductor shortages and inflation. Regardless of these challenges, we will operate our business in a lean and flexible manner. This will be accomplished by continuing to develop and promote appealing products while seeking to improve profitability through the enhancement of the robust corporate constitution fostered under Reborn21. Another measure toward this end will be to bolster our responsiveness to changes in the operating environment, which I will talk about a little later on.

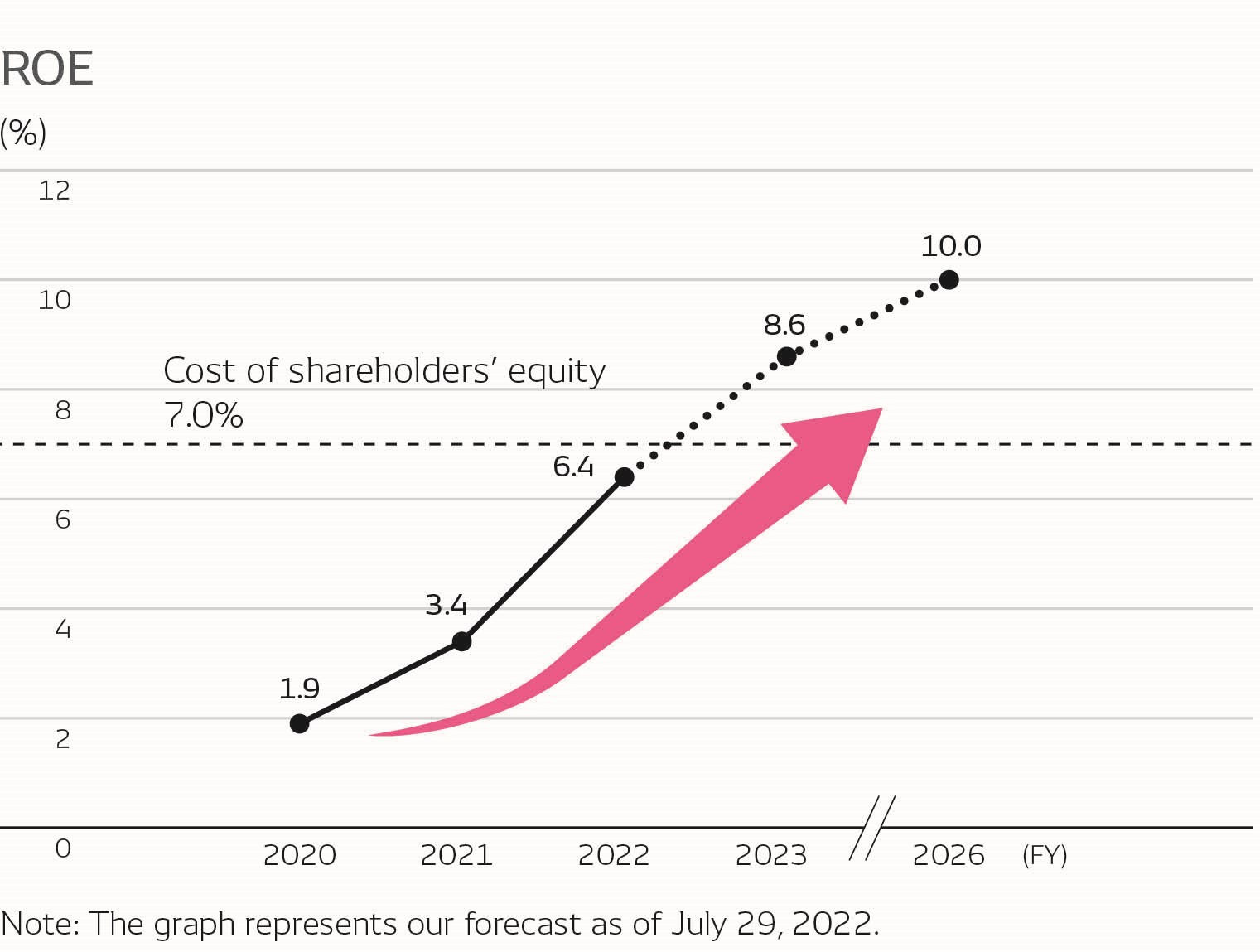

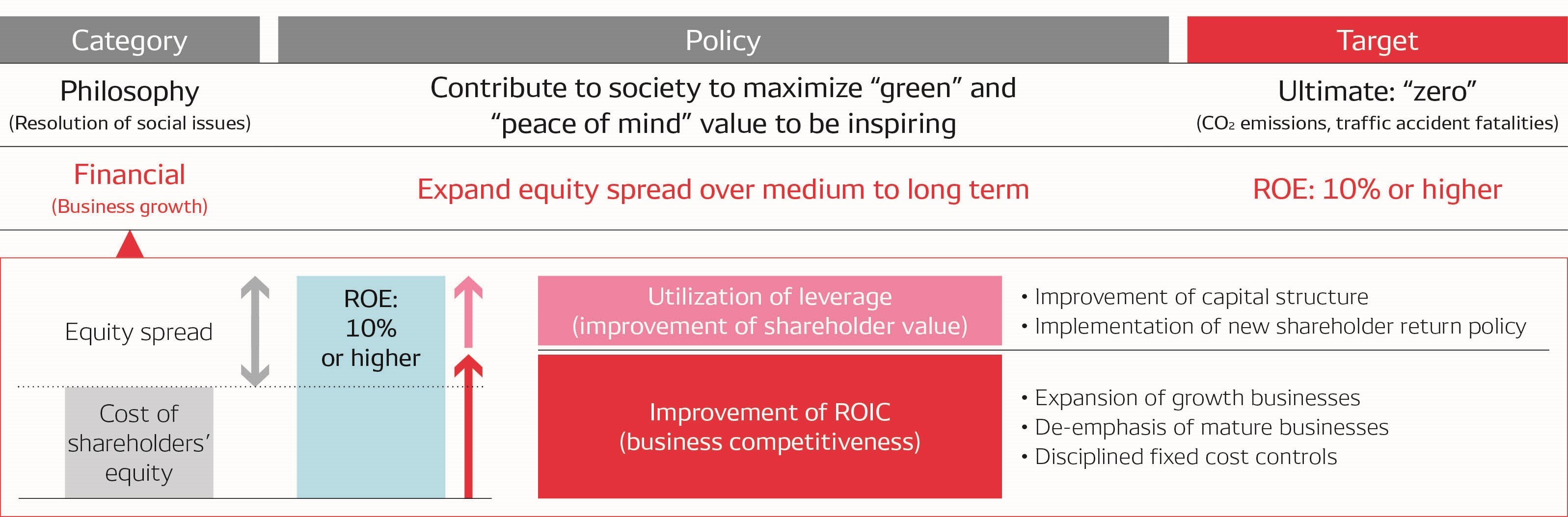

Moreover, DENSO has set the new Mid-term Policy for 2025, which defines goals to be accomplished by fiscal 2026. This policy clarifies our intent to take on an extensive reorganization of our business portfolio. Through this reorganization, we will seek to solidify earnings foundations in order to achieve return on equity (ROE) of 10% or higher and an operating margin of 10% in fiscal 2026. To accomplish these targets, we launched a new financial strategy in fiscal 2022 that emphasizes managing capital costs to maximize ROE through corporate value creation (the creation and expansion of genuine equity spread). In fiscal 2022, ROE was 6.4%, up 3 percentage points year on year. As of July 29, 2022, we expect this figure to rise to 8.6% in fiscal 2023, an amount that will surpass cost of shareholders’ equity. I feel that the frameworks for continuously generating value at DENSO are taking shape. Accordingly, we will continue to move forward with the four pillars of our new financial strategy—(1) reinforce profit structure, (2) reduce low-profit assets, (3) improve capital structure, and (4) engage in dialogue with markets— in order to ensure we accomplish the targets of the Midterm Policy for 2025. I would now like to explain some of the concrete initiatives we are implementing toward this end and the progress of these initiatives.

1. Reinforce Profit Structure—Acceleration of Business Operation Focusing on Expansion and Reinforcement through Entrenchment of ROICMinded Management

(1) ROIC-Minded Management for Heightening Corporate Value

A. Start of ROIC-Minded Management

DENSO has introduced ROE among the key performance indicators (KPIs) for which it has set targets alongside prior financial KPIs like revenue and operating profit. This move was made to accommodate a shift toward management emphasizing capital cost and corporate value under the new financial strategy launched in fiscal 2022 and to respond to changes in the operating environment and in the expectations of stakeholders.

The target for ROE has been set at 10% or higher to facilitate the creation and expansion of genuine equity spread. Considerations for setting this target included the fact that the Company’s cost of shareholders’ equity is currently around 7% and that the minimum level expected by society, as indicated in documents like Ito Report 2.0, is 8%. To expand genuine equity spread, we will be taking advantage of our leverage to accomplish objectives like improving our capital structures and enacting new shareholder return policies. At the same time, however, we realize that there is a need to heighten the competitiveness of our business in a manner that is not overly dependent on leverage if we are to continue creating value. Based on this belief, we commenced a full-fledged management approach that is mindful of return on invested capital (ROIC) in fiscal 2022.

With a focus on the management KPI of ROIC, we will aspire to make management decisions for expanding growth businesses, de-emphasizing mature businesses, and exploring new businesses to achieve continuous increases in corporate value.

B. Entrenchment of ROIC-Minded Management

At DENSO, ROIC is more than just a management KPI; it is a tool for promoting changes in the behavior of employees. We began rolling out an “ROIC tree” in fiscal 2022 that allows employees to clearly see the connection between management KPIs and their individual improvement activities. In addition, our in-house publications are regularly used to provide information, on a global basis, on the relationship between the improvement activities of individual employees and divisions and the enhancement of ROIC.

Through these efforts, we are constantly working to foster awareness of ROIC. In addition to such ongoing communication and awareness-raising activities by corporate divisions, we are also bolstering education for business planning departments and accelerating activities for conveying our ROIC-minded management via planning departments through the formulation and implementation of ROIC improvement initiatives based on the characteristics of the given business.

Furthermore, ROIC was introduced to complement operating profit as an indicator for determining the performancelinked compensation of members of the Board in fiscal 2023. To increase incentives for pursuing medium- to longterm improvements in corporate value, a restricted stock compensation plan was implemented in fiscal 2021. The addition of ROIC as an indicator for calculating compensation, meanwhile, is expected to strengthen the commitment to short-term results of senior management and to heighten their desire to increase ROIC and create value.

In this manner, we are advancing activities targeting everyone, from regular employees to senior management, in order to further entrench the practice of truly ROICminded management for improving value.

(2) Business Portfolio Reorganization for Boosting Earnings and Exercising Philosophy

A. Pursuit of Sustainable Growth by Resolving Social Issues through Business

We view the “resolution of social issues through our businesses” as the bedrock of our management. With this as our foundation, we are pursuing our ultimate goal of “zero” in the fields of “green” and “peace of mind,” by which we mean zero CO2 emissions and zero fatalities from traffic accidents. Through our pursuit of this goal, we hope to inspire our stakeholders and thereby achieve ongoing improvements to our competitiveness. In the current uncertain operating environment, DENSO will seek to reorganize its portfolio to facilitate efforts to exercise its philosophy, accelerate its growth, and boost profitability in terms of ROIC. This is the approach we will take to continuously grow our value by protecting the environment, contributing to peace of mind, and inspiring stakeholders.

;

;

B. Growth in the Electrification and Advanced Safety Areas of the CASE Domain

In the CASE domain (connected driving, autonomous driving, sharing, and electrification), DENSO prides itself on its role in and capacity for shaping the industry. We are particularly capable when it comes to the areas of electrification and advanced safety.

The global trend toward electrification is accelerating amid rising environmental awareness. DENSO built development and production systems in this area ahead of its competitors, and these systems have supported our progress in selling our products to overseas and other customers. In fiscal 2023, our eAxle inverter-equipped drive module was adopted, for the first time, for use in a customer’s product through BluE Nexus Corporation. This development allowed us to achieve an aggregate total of 20 million inverter products, a feat never before seen among our competitors. Global Safety Package 3 is equipped with state-of-the-art technologies that contribute to “peace of mind” value by helping realize freedom in mobility with zero traffic accident fatalities through an increased range of applicability to accidents. In addition, this product helps make equipment smaller and reduce costs, thereby contributing to profits by supporting business growth and increases to earnings power.

Going forward, we will continue to pursue growth in these fields in order to maximize the value we provide in line with the principles of green and peace of mind.

As for the field of advanced safety, we commenced mass production of Global Safety Package 3 in fiscal 2022 amid the rising needs for safety and peace of mind in mobility. This trend is evident among the growing social issues pertaining to increases in the number of accidents by senior citizens and ever more serious traffic congestion in urban areas.

C. Strategy Positioning Semiconductors as Key Growth Devices

A sharp increase in semiconductor demand has been seen in recent years, resulting in supply instability. However, this situation has not changed the fact that semiconductors are key devices to the automotive industry, meaning that the evolution of semiconductor technologies and the reliability of semiconductor supplies will be imperative to the popularization of vehicles that contribute to green and peace of mind value. For this reason, DENSO is bolstering areas in the chain spanning from advanced technology development through to production systems that are easily overlooked, with a goal of contributing to the entire industry.

The development of advanced technologies in this area is being spearheaded by R&D subsidiary MIRISE Technologies Corporation. For production and supply, we have partnered with United Semiconductor Japan Co., Ltd., to develop a system capable of high-performance, high-efficiency production of Japan’s first 300-mm-wafer power semiconductors. In addition, we commenced investment in Japan Advanced Semiconductor Manufacturing, a subsidiary of Taiwan Semiconductor Manufacturing Company, Ltd., to construct a system for the stable supply of these devices.

DENSO has continued to make contributions to the environmental performance of automobiles with its semiconductor technologies, as seen in the use of its power module equipped with a next-generation SiC device in the Toyota MIRAI. Together with our partners, we are committed to the ongoing reinforcement of development, mass production, and other systems.

D. De-Emphasis and Discontinuation of Businesses

The reorganization of our business portfolio will require us to de-emphasize or discontinue certain businesses. When we think about the trust-based relationships we have built with customers thus far, it becomes easy to adopt a negative opinion of such undertakings, which can make it difficult for us to move forward.

However, it is important for us to take a forward-looking perspective toward the de-emphasis and discontinuation of businesses if we are to exercise our philosophy and achieve sustainable growth. For this reason, we began undertaking business transfers in fiscal 2022 with a sense of conviction while actively working to gain the understanding of customers.

For example, we reached an agreement to transfer our fuel pump business to Aisan Industry Co., Ltd., in January 2022. Discussions with customers took place from the early stages of this business transfer to ensure that we did not betray the expectations of customers or of society through this move. Another such undertaking was the transfer of our type III alternator business to Chengdu Huachuan Electric Parts Co., Ltd. In this manner, we are making steady progress in deemphasizing and discontinuing businesses.

Moreover, in fiscal 2023, we transferred some of the products from businesses designated to be de-emphasized or discontinued to the Powertrain Systems Business Group, an organization that has been playing a central role in these activities with regard to internal combustion engine products. This reorganization has allowed us to expedite decisions and better gain customer understanding in relation to the de-emphasis and discontinuation of businesses under the guidance of a single organization.

We are also taking a committed approach toward consolidating regional production subsidiaries to optimize production and supply systems from a medium- to long-term perspective, a part of the de-emphasis and discontinuation of businesses. This commitment drives us forward in restructuring activities.

Looking ahead, the reorganization of our business portfolio, including reorganizing subsidiaries and transferring and withdrawing from businesses through coordination with partners, will be advanced with decisive speed.

;

;

E. Creation of New Value

We are currently in a highly volatile operating environment that is presenting a plethora of new social issues. DENSO seeks to take preemptive action for contributing to the resolution of these social issues. To guide us in this undertaking, we have formulated theories regarding the social issues that will emerge in 2035 based on megatrends projected leading up to 2050. These theories are shaping our efforts to explore new businesses based on our desire to contribute to the resolution of such social issues through activities in our business domains and through the use of our core competencies.

In the past, we have applied the strengths fostered over our long history in the automotive business to nonautomotive businesses, such as factory automation and AgTech, to expand our business domains. Continuing this trend, we launched businesses in new fields in fiscal 2023 to broaden the scope of areas in which we contribute beyond automobiles to include mobility, Monozukuri (manufacturing), and society.

One concrete example of our advancements in the new field of mobility can be seen in the adoption of a product that we jointly developed with U.S. aircraft manufacturer Honeywell International Inc. for use in the all-electric vertical take-off and landing (eVTOL) aircraft of the Germanbased company Lilium GmbH. This decision was made in fiscal 2023. Electric aircraft are gaining attention as a new mobility option for addressing social issues related to urban traffic congestion and the related CO2 emissions as well as for providing transportation venues in isolated areas. These vehicles are congruent with DENSO’s principles of “green” and “peace of mind.” Accordingly, we are accelerating development to assist in the production of electric aircraft for practical application.

Other initiatives include collaborating with partners to utilize the data acquired from DENSO drive recorders for use in the development of services that detect signs of dangers and help prevent accidents. We thereby look to provide a new form of peace of mind value.

In today’s volatile environment, it is important that we do not become complacent with simply improving existing businesses. Rather, we must promote “ambidextrous management” by actively exploring new businesses in new fields and through new partnerships in order to create new value. Through our management approach, we will seek to generate value via preemptive response to social changes.

(3) Flexible Response to Operating Environment Changes and Risks

A. Acceleration of Transition to Cost Structures Resilient to Change and Risks

Since fiscal 2021, we have been moving forward with the development of earnings structures that are resilient to change, a pillar of “Reborn21,” to ensure that we can secure a profit even if revenue drops by 30%. Cost cutting has been part of these efforts, and we have thereby managed to lower the break-even point by 6 percentage points over the past two years. The break-even point stood at 74% on March 31, 2022. The operating environment is expected to grow increasingly challenging, and the automotive and manufacturing industries are falling upon hard times. Nevertheless, DENSO is committed to ongoing cost structure reforms to guarantee that it can respond flexibly in any environment.

B. Resource Allocation Reforms

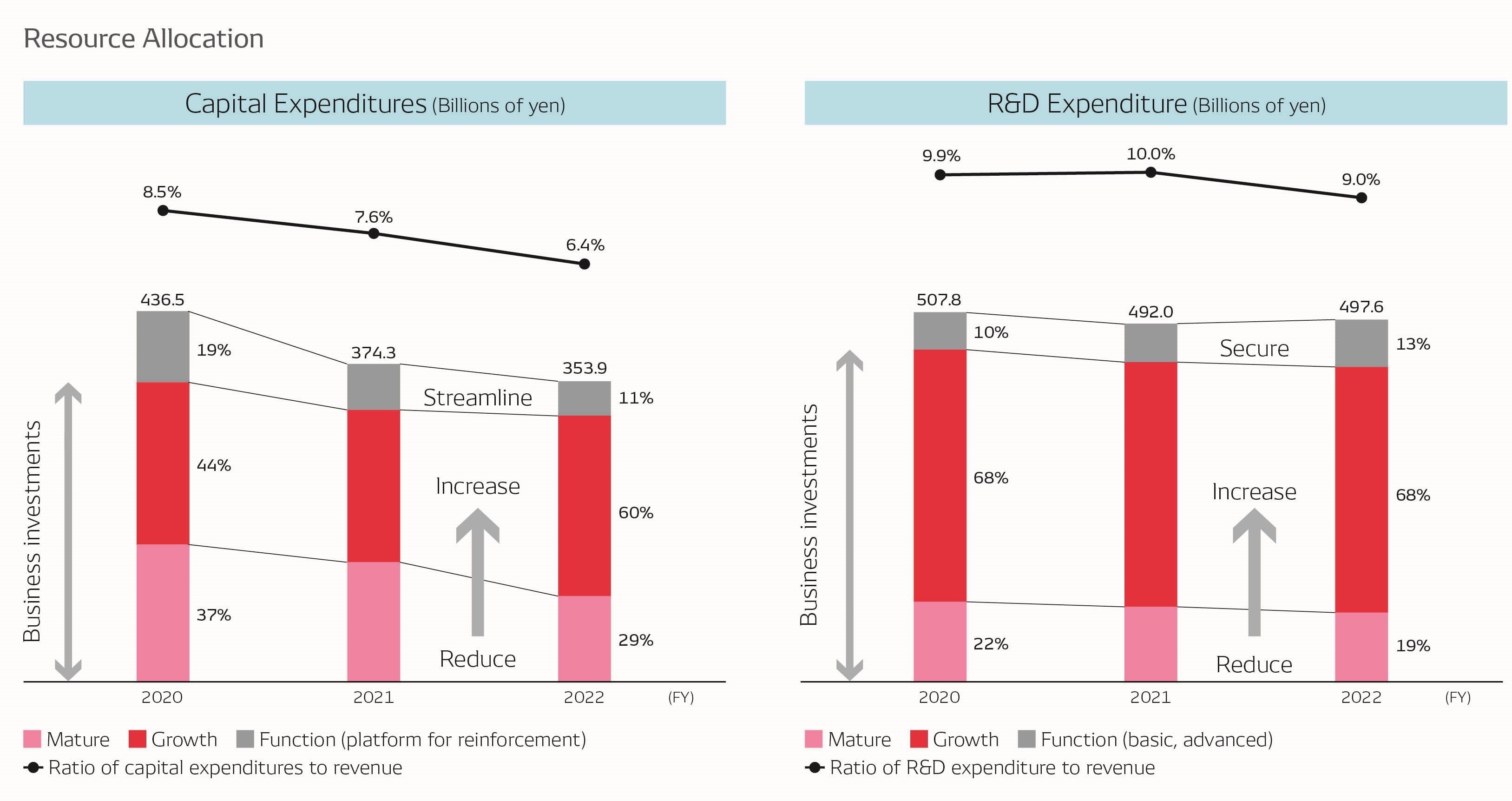

Our resource allocation targets for fiscal 2026 are capital expenditures of ¥350.0 billion and R&D expenditure of ¥450.0 billion. Based on these targets, we will take a disciplined approach toward allocating our limited resources in order to utilize these resources to their maximum extent for driving business growth.

We have already changed the focus of our capital expenditures from internal combustion engines to the CASE domain. Specifically, we are consolidating production locations on a global scale and reorganizing our production system to reduce the amount of resources allocated to internal combustion engines. In this manner, we are pursuing improvements to optimize resource allocation.

In regard to research and development, the range of fields to which we need to allocate resources is broadening to include electrification, advanced safety and automated driving, connected driving, and non-automotive businesses. Accordingly, we are introducing digital technologies and automation tools and taking other steps to heighten development efficiency in order to make the best possible use of our resources.

C. Enhancement of Responsiveness to Change

Expenses in fiscal 2023 are expected to be roughly three times the amount of fiscal 2022. This increase in costs will be the result of repeated hikes to the prices of semiconductors, soaring logistics costs, and rises in energy costs due to the war in Ukraine. Combating this rapid deterioration of our operating environment will require us to enhance our responsiveness to change.

To this end, we are working to reduce expenses and to transfer costs to customers. For example, we are using AI-powered tracking technologies to bolster management of signs of abnormality in maritime transportation and to thereby increase the accuracy of our arrival estimates so that we can refrain from using high-cost air transportation as much as possible. At the same time, we are engaging in earnest discussion with customers to gain their understanding as we ask to transfer costs to transaction prices with them in order to overcome this crisis facing the entire industry

;

;

2. Reduce Low-Profit Assets— Improvement of Asset Efficiency by Determining Ideal Asset Levels

DENSO seeks to utilize its asset portfolio with the greatest levels of efficiency by determining the necessary levels of certain types of assets in order to downsize asset amounts.

(1) Optimization of Cash on Hand

We have been working to optimize cash on hand by minimizing the funds needed for business operation (standard business funds) and reducing uneven asset distribution by region through the use of the Global Cash Management System (GCMS). DENSO has set a cash on hand target of 1.1 times the amount of monthly revenue for the total of standard business funds and rainy-day funds for emergency circumstances. We have more or less been able to maintain fund levels that match this target. Going forward, we will target cash on hand of 1.0 times the amount of monthly revenue in order to bolster efficiency even as we seek to grow.

(2) Curtailment of Cross-Shareholdings

We have decided to widen the scope of cross-shareholdings for which we are examining possible curtailment to include not only shares held by the Company but also those of subsidiaries. By doing so, we are promoting reductions that exceed the requirements of Japan’s Corporate Governance Code. In fiscal 2022, we sold approximately ¥54.6 billion worth of holdings by the Company through total or partial sale of holdings of nine companies. As a result, the total number of cross-shareholdings came to 24, a reduction from 44 on April 1, 2019, three years ago. Going forward, we will continue to curtail such holdings so that the cash generated through the sales of holdings can be used to invest in creating corporate value as dictated by growth strategies.

(3) Optimization of Inventories

Since the start of the COVID-19 pandemic, we have faced an opaque operating environment due to semiconductor shortages, logistics disruptions, and other detractors. In the face of this adversity, we have endeavored to secure stable supplies in order to maintain the inventories necessary for responding flexibly to fluctuations in demand. As a result, inventories amounted to around ¥1 trillion on March 31, 2022. When the current extreme circumstances have dissipated, we will define target levels for different types of inventories through global coordination among domestic and overseas bases in order to swiftly optimize inventory levels.

For this purpose, we will track temporary inventories, strategic inventories, and standard inventories. Temporary inventories refer to those held in response to logistics disruptions and other operating environment factors. Strategic inventories are those traditionally held to hedge against natural disaster risks and against tight supply–demand balances for electronic components and other items. Standard inventories are those held for use in production activities under normal circumstances. By sharing issues and directives for optimizing the levels of these inventories on a Companywide basis, we aim to maintain an up-to-date understanding of inventory conditions and cultivate an awareness of issues.

In this manner, we will seek to overcome adversity through concerted efforts based on careful analysis in order to further cement our operating foundations.

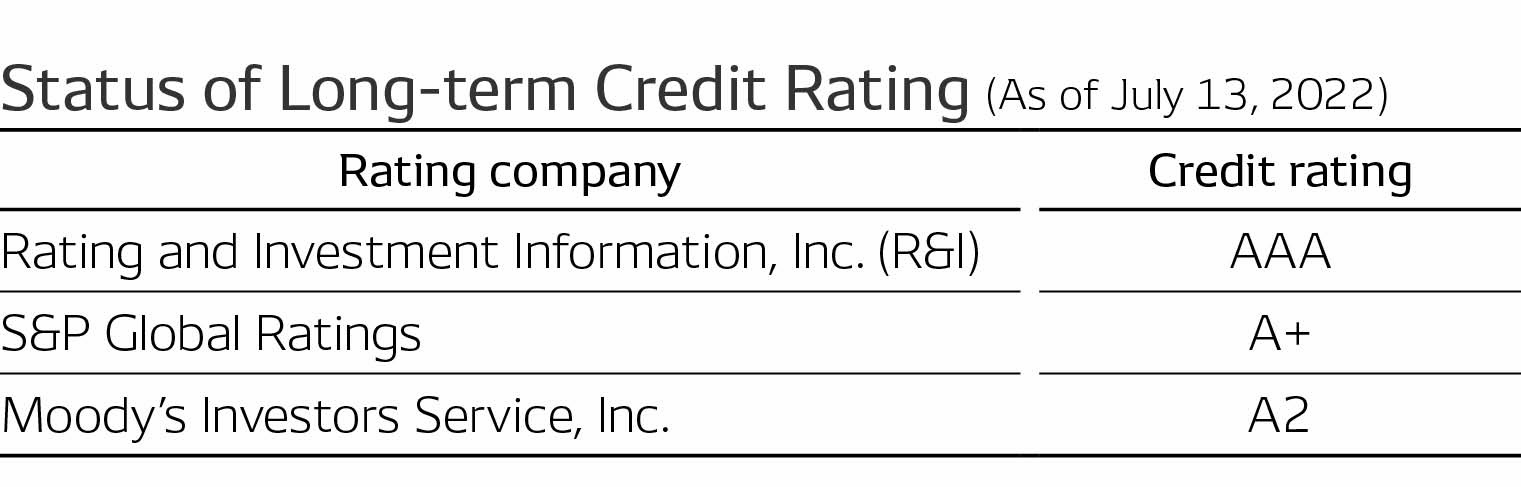

3. Improve Capital Structure— Pursuit of Targeted Capital Structure by Bolstering Funding Platform and Issuing Proactive Shareholder Returns

We look to reduce capital costs while maintaining a balance between safety and efficiency and to utilize borrowings, diversify funding sources, and issue proactive shareholder returns in order to create corporate value.

(1) Utilization of Borrowings and Diversification of Funding Sources

DENSO prepares for future large-scale investments by diversifying funding sources through the utilization of borrowings from banks and domestic and overseas corporate bonds, among other sources.

In fiscal 2022, the Company issued its first U.S. dollardenominated sustainability bonds. Through the issuance of sustainability bonds, from which the procured funds can only be used for development and investment projects in “green” and “peace of mind” fields, we hope to communicate, on a global scale, the business activities founded on sustainability management that we have advanced since our founding and the successes of these activities. In this manner, we look to accelerate our initiatives for responding to environmental and social issues. The choice to denominate these bonds in U.S. dollars was made to allow for funds to be procured in greater amounts from a wide variety of investors in the large overseas market. We have thereby succeeded in developing a stable funding platform that will enable us to invest in growth fields and new businesses and to take part in M&A activities and alliances. Further improvements to capital efficiency will be pursued going forward by utilizing foreign currency-denominated corporate bonds and other types of borrowings while maintaining a high degree of financial health.

(2) Shareholder Return Policies

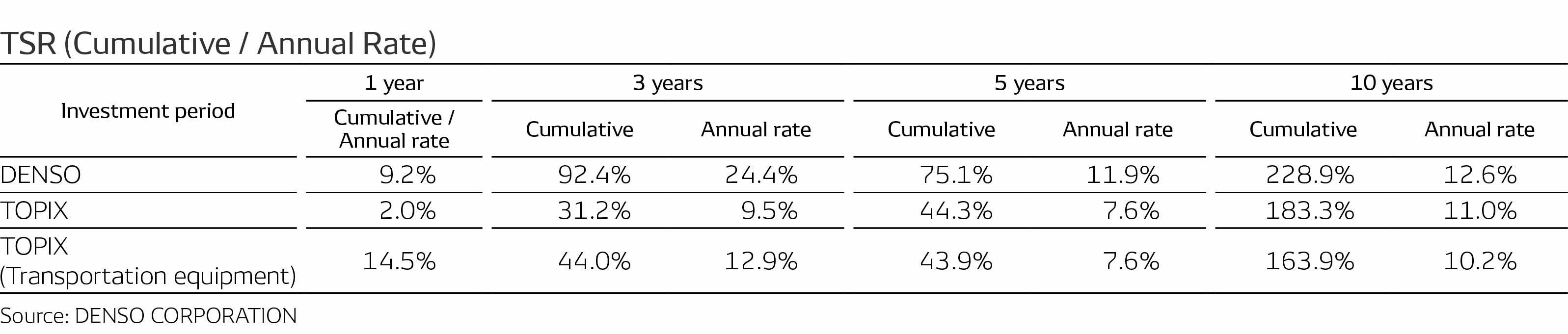

DENSO aims to issue stable shareholder returns that exceed cost of shareholders’ capital over the long term by increasing both dividends (income gain) and share price (capital gain).

For dividends, we have a basic policy of consistently growing dividend on equity (DOE: Dividends ÷ Shareholders’ equity) from the level of 3.0%. Accordingly, we increased dividend payments by ¥25 per share year on year in fiscal 2022, making for DOE of 3.1%. As for treasury stock acquisition, we have acquired 12 million shares, or ¥97.5 billion worth, of treasury stock in fiscal 2022. The scale of this acquisition was determined by comparing our targeted capital structure and theoretical stock price with the reality based on our long-term business plan. Our new financial strategy calls on us to transition to new shareholder return policies, and we have thus doubled the amount of shareholder returns from fiscal 2022.

Looking ahead, we will continue to issue proactive shareholder returns through stable, long-term dividends and flexible and effective treasury stock acquisitions in order to improve our capital structure and subsequently our corporate value.

4. Engage in Dialogue with Markets— Acceleration of Dialogue through Increased Communication Regarding Non-Financial Capital

Through its investor relations activities, DENSO is communicating information to investors and analysts in a timely and appropriate manner and advancing a dialogue through efforts by corporate officers. By doing so, we aim to reduce information gaps with capital markets in our efforts to enhance our corporate value.

In fiscal 2022, we arranged online meetings with an aggregate total of 1,000 companies, roughly double the number from fiscal 2021, amid the significant restrictions on communication with investors imposed by the COVID19 pandemic. In addition, we held DENSO DIALOG DAY 2021, our first time to hold such an event in two years, thereby gaining a great deal of support and input.

Meanwhile, DENSO is ramping up sustainable management initiatives from an ESG perspective in light of the rising attention being turned toward ESG issues. An area of particular attention in this regard is human capital and other forms of non-financial capital. We are swiftly moving forward with investments in intangible assets, including those aimed at human resource development and R&D, based on the belief that such forward-looking investments will translate directly to growth and improved corporate value. There is no denying that investments in intangible assets have been integral to DENSO’s ability to continuously provide value that preemptively addresses the needs of the times. We therefore recognize that non-financial capital will be a key factor underpinning our competitiveness over the medium to long term. Based on this recognition, we are accelerating forward-looking investment in non-financial capital while working to achieve higher levels of investment efficiency. We will also look to quantify the benefits of investment in non-financial capital and to clarify how such investments relate to DENSO’s value creation activities. This will be imperative to ensuring that stakeholders accurately evaluate our growth potential. This is one of the reasons we are expanding the provision of information on non-financial capital through investor relations activities.

These investor relations activities were highly evaluated in fiscal 2022, leading DENSO to be ranked 1st in the automobile, automotive parts, and tires category in the 2021 Awards for Excellence in Corporate Disclosure presented by the Securities Analysts Association of Japan. In addition, DENSO Integrated Report 2021 received a silver award in the 2021 WICI Japan Integrated Report Award program. This is just one of several honors bestowed upon this report, which have given us numerous opportunities to use our integrated report as a communication tool. Meanwhile, the semiconductor business briefing arranged in fiscal 2023 was incredibly well received. In winter, we are planning to hold DENSO DIALOG DAY 2022. Through such activities, we will continue to gather input from the market for use in heightening the quality of management.

Closing

A glance at the global market will reveal a state of turmoil, the likes of which is rarely seen, spreading across the entire industry. Factors contributing to this turmoil include semiconductor shortages, logistics disruptions, and inflation. Personally, I believe that this turmoil presents a significant opportunity for DENSO to change. This is why it is so important for us to take a proactive approach in faithfully implementing the financial strategy I have spoken of. I would like to promise our success in de-emphasizing and discontinuing internal combustion engines and other mature businesses, growing the CASE domain and new businesses, and implementing semiconductor strategies to drive the creation of corporate value. We will be pooling the knowledge of our 170,000 global employees in order to accomplish these objectives. I am sure that these efforts will allow us to show you an even stronger DENSO as we approach 2025. We ask that you look forward in anticipation as we pursue these endeavors.