CFO MESSAGE

Financial Strategy for Resolving Social Issues While Realizing Business Growth

Yasushi Matsui : CFO(Chief Financial Officer) Executive Vice President, Representative Member of the Board

Financial Strategy for Realizing the Mid-term Policy for 2025

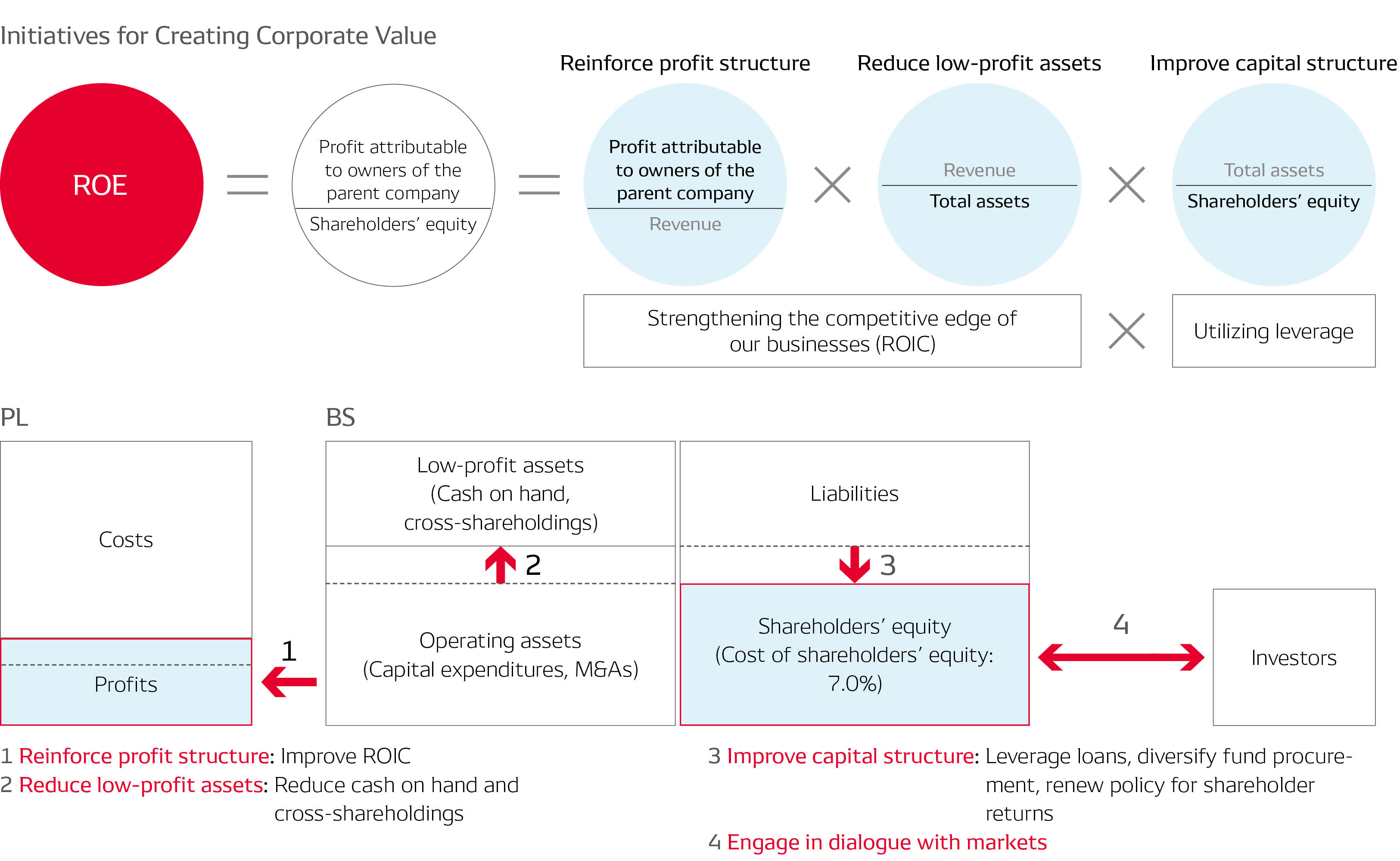

DENSO’s sustainability management focuses on “resolving social issues by maximizing the value of green and peace of mind to be inspiring” and “expanding genuine equity spread over the medium to long term.” By implementing this management approach, we aim to enhance our corporate value in a sustainable manner. Furthermore, guided by management with an awareness of capital cost, we established return on equity (ROE) as our most important KPI from a financial perspective.

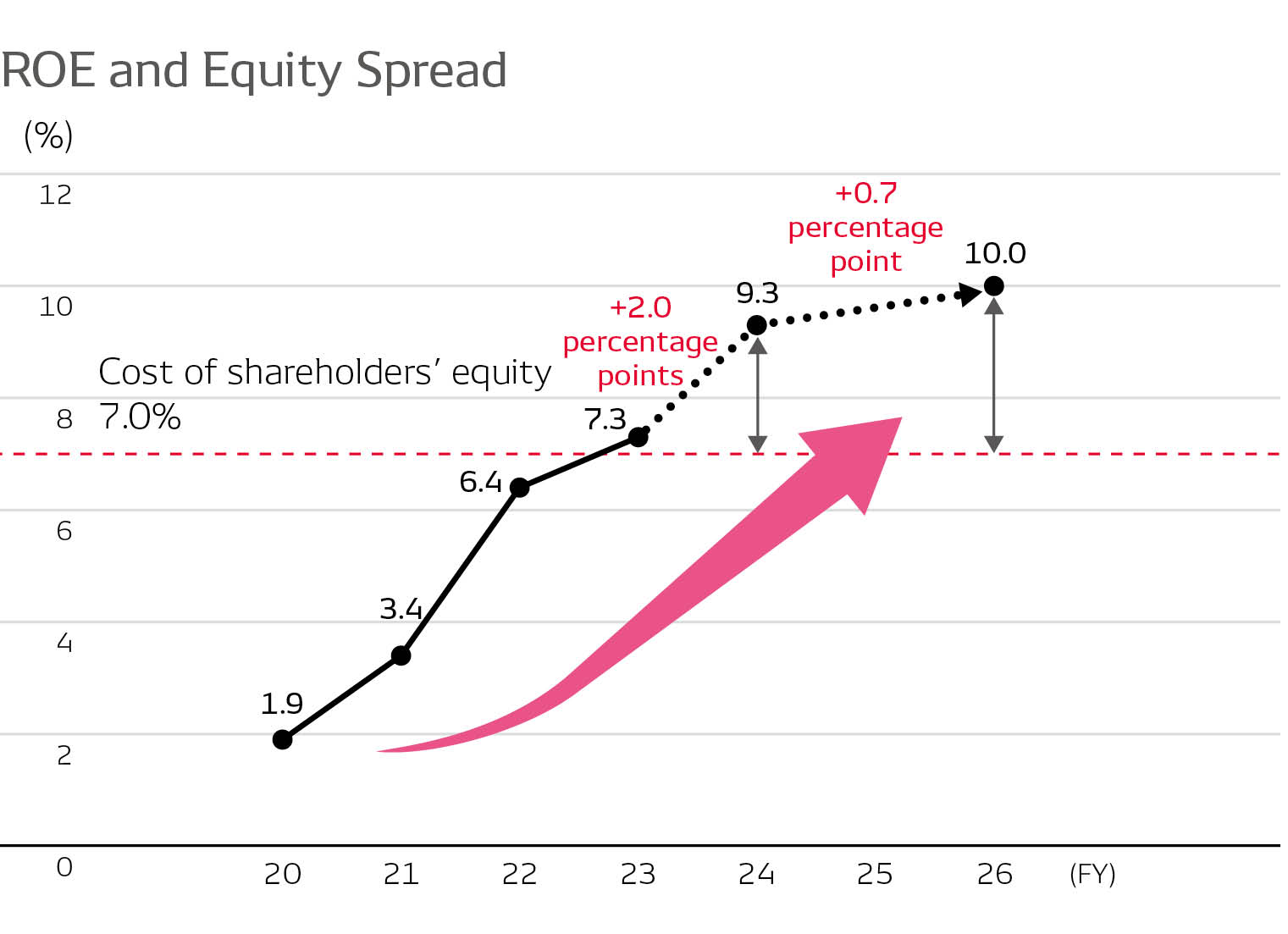

Under the Mid-term Policy for 2025, we have set a target for ROE of 10% or higher with the aim of maximizing value creation by having ROE exceed the Company’s current cost of share-holders’ equity of around 7% and the minimum level expected by society, as indicated in documents like Ito Report 2.0, of 8%.

As CFO, I will seek to realize this target through the agile promotion of a financial strategy supported by four pillars: (1) reinforce profit structure, (2) reduce low-profit assets, (3) improve capital structure, and (4) engage in dialogue with markets.

Overcoming the Rapidly Changing External Operating Environment to Realize Further Corporate Value Creation

In fiscal 2023, despite a market recovery from the impacts of the COVID-19 pandemic, our performance was significantly impacted by negative developments in the external operating environment, including a decline in vehicle production due to prolonged semiconductor shortages, soaring prices of materials, primarily electronic components, logistics costs, and energy costs. In such an environment, we pursued efforts to expand sales in focus fields such as electrification and advanced safety systems and promote rationalization by improving productivity and other areas. We also worked diligently to strengthen our response capabilities to overcome the challenges presented by the worsening conditions in the external operating environment. As a result of these endeavors, revenue increased 16.1% year on year, to ¥6,401.3 billion, and operating profit was up 24.9%, to ¥426.1 billion, both reaching record highs.

In fiscal 2024, while semiconductor shortages are likely to gradually be resolved, we expect to continue to see a challenging operating environment, including in terms of inflation. Even under these adverse conditions, we will strive to achieve record-high revenue and profits for the second consecutive year by developing and expanding sales of attractive products, rigorously controlling fixed costs, and further enhancing our ability to respond to change.

ROE in fiscal 2023 came to 7.3%, a 0.9 percentage point improvement over the previous fiscal year, thereby exceeding the Company’s cost of shareholders’ equity. Through efforts to further strengthen profitability, we expect to achieve ROE of 9.3% in fiscal 2024, steadily making progress toward our fiscal 2026 target (as of the release of our first quarter financial results for fiscal 2024).

Under the Mid-term Policy for 2025, we declared our commitment to creating social value by realizing the goal of “ultimate zero,” meaning that we achieve carbon neutrality and eliminate fatalities from traffic accidents.

From here, I will explain specific initiatives we are implementing to both resolve social issues and realize business growth, in accordance with the four pillars of our financial strategy.

1. Reinforce Profit Structure: Business Management Focused on Realizing the DENSO Philosophy

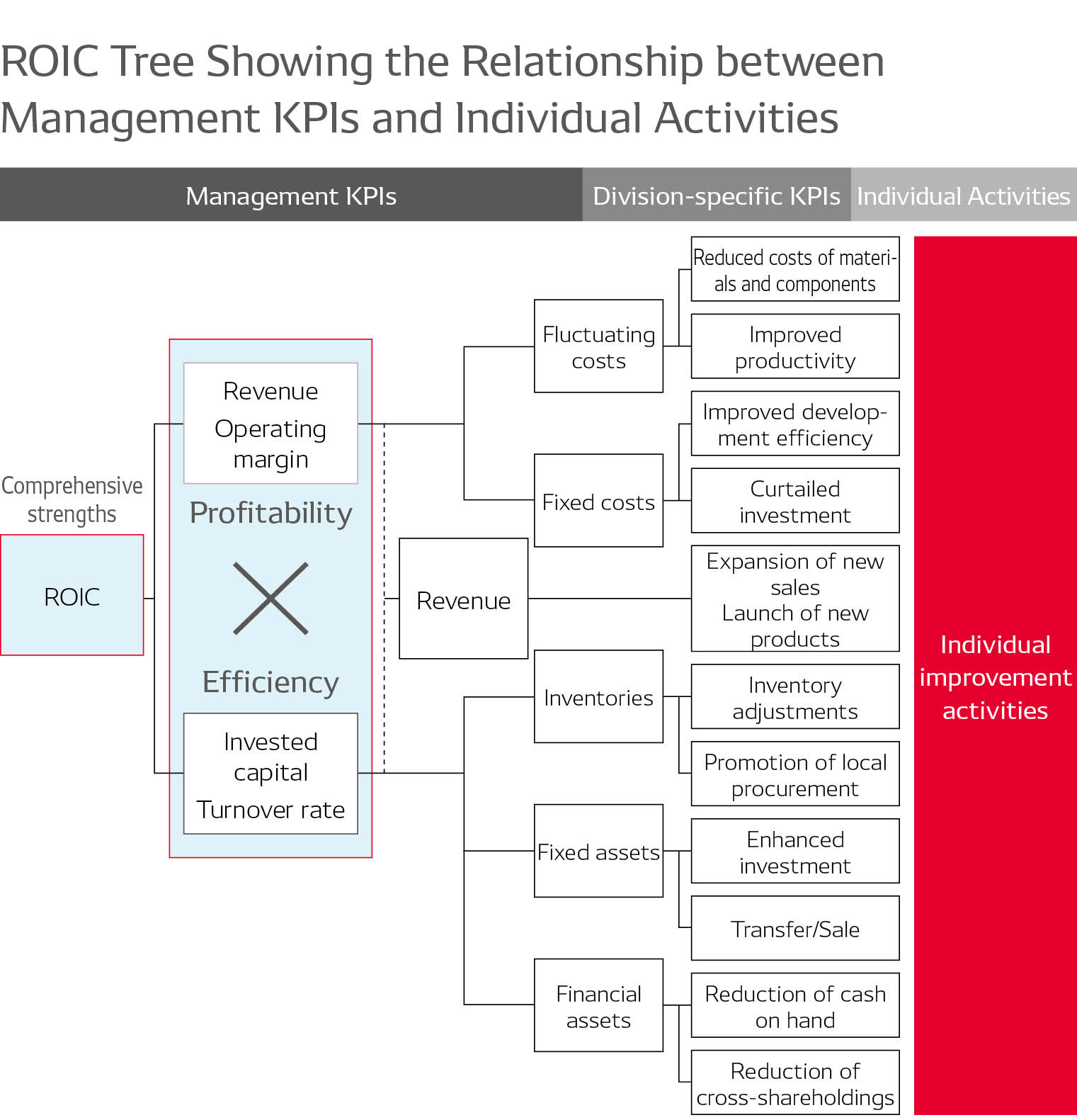

(1) Evolving ROIC-Minded Management Geared toward Corporate Value Enhancement

DENSO’s ROIC-minded management is not a method for short-term improvement in financial indicators but rather aims to enhance corporate value over the medium to long term.

Through ongoing awareness-raising activities that cover various angles, including the in-house rollout of an “ROIC tree,” regular educational activities, and the sharing of improvement examples in global in-house publications, we are working to instill a deep understanding of the significance of our financial indicators in all of our employees. By doing so, we are implementing ROIC-minded activities on a continuous basis. Various examples of improvements have been seen in our frontline operations since the introduction of ROIC-minded management, and I feel that the ongoing efforts of our employees have gradually boosted our ROIC on a Companywide basis.

In addition, since fiscal 2023 we have added ROIC as a metric for determining the performance-linked compensation for members of the Board. By disclosing our targets for ROIC in fiscal 2024, we are further reinforcing the awareness of and commitment to ROIC by senior management.

We have entrenched a strong awareness of ROIC throughout many layers of the Company in the approximately two years since introducing ROIC-minded management, and we will seek to enhance this awareness even more moving forward.

(2) Reshuffling Business Portfolio to Realize the DENSO Philosophy and Achieve Business Growth

A. Striving for Sustainable Growth by Responding to Constantly Changing Social Issues

We believe that creating social value in the domains of green and peace of mind and inspiring our stakeholders will enable us to sustainably sharpen our competitive edge. As the value needed by society continues to change, we will perpetually reshuffle our business portfolio from the perspectives of realizing the DENSO philosophy, accelerating growth, and boosting profitability in terms of ROIC. This approach will allow us to create social value in a sustainable manner and achieve business growth.

Guided by this approach, we will reduce our number of products with a high burden on the environment, primarily internal combustion engines, and invest the resources gained by doing so in growth fields, such as electrification and advanced safety, and new businesses that offer new value. In these ways, we will achieve sustainable growth and high profitability.

B. Realizing Carbon Neutrality by Popularizing EVs

To date, DENSO has contributed to the electrification of vehicles, leading the way ahead of other companies with such initiatives as the development of electrification technologies and the establishment of a global production structure. With heightened environmental awareness across the globe and the accelerated shift toward EVs, the needs of our customers are diversifying. In light of these trends, there are now greater expectations of DENSO due to our extensive product lineup and exceptional proposal-making capabilities.

Inverters are one of our mainstay products in the field of electrification. We have already commenced the mass production of inverters in North America and China, and we expect to do the same in Europe in fiscal 2024. By doing so, we will steadily expand sales and bolster production capacity with a view to achieving an annual production of 12 million inverters by fiscal 2026.

In terms of development, we have launched into the inverter market using silicon carbide (SiC) power semiconductors (SiC inverters), which greatly reduce the electricity consumption of BEVs. These SiC inverters have been adopted in the new LEXUS RZ, the vehicle manufacturer’s first BEV model. These SiC inverters reduce power loss by nearly half compared with conventional inverters that use silicon (Si) semiconductors, thereby helping improve the driving distance of BEVs.

While SiC inverters garner even greater attention due to the rapid transition to BEVs, DENSO is striving to enhance the competitiveness of SiC inverters, in terms of both output and cost, through proprietary technologies such as trench-type metal-oxide-semiconductor (MOS) structures, which help achieve a high-voltage operation of BEVs, and dual-side engine-cooling and other long-cultivated vehicle-cooling technologies.

Furthermore, DENSO possesses both battery management systems that utilize a safe, highly efficient power source control to enhance driving distance and heat management systems that make use of waste heat and battery temperature for vehicle heating, thereby increasing driving distance by approximately 20%. In addition to these products, we have technologies that can realize eco-friendly, highly efficient electrification through system-wide control that makes use of our ECUs. These technologies represent our greatest strength as a comprehensive systems supplier.

Going forward, we will realize carbon neutrality by bringing together our broad range of technologies to further contribute to the electrification of vehicles.

C. Developing Advanced Safety Technologies That Can Eliminate Fatalities from Traffic Accidents

In the field of advanced safety, we have been expanding product sales on a global basis and steadily increasing the value we provide through safety, including by commencing the full-scale mass production of Global Safety Package 3 (GSP3), a driver support system that greatly expands the settings in which accident prevention systems are used.

GSP3 combines sensing and image recognition technologies—two strengths of the Company—that can detect a large volume of data and process it at high speeds, thereby supporting accident prevention in a diverse range of settings. With this improved functionality, GSP3 has been praised by our customers as a high-value-added product that greatly enhances safety and has helped us significantly improve profitability.

Additionally, we are steadily undertaking the development of next-generation technologies. By extending the range of protection of our safety systems to encompass the entire vehicle, we are on track to enhance the range of applicability by 2025 to offer protection in 56% of all possible scenarios in which we anticipate fatalities from accidents occurring.

To provide coverage for the remaining 44%, in addition to our own initiatives, collaboration is needed between relevant government agencies, car manufacturers, and companies in adjacent industries so that we can promote a three-pronged approach encompassing people, cars, and traffic environments. To that end, we are pursuing the development of even more advanced safety technologies. These include infrastructure coordination systems that recognize hazards in the blind spots of vehicles and systems utilizing our superior HMI* technologies that go so far as to monitor the driver’s condition, level of skill, and driving tendencies.

Through the advancement of safety products that combine cutting-edge technologies, we will help realize freedom in mobility with zero traffic accident fatalities.

* Human–machine interface

D. Promoting Strategies That Position Semiconductors as Key Devices for Accelerating Growth

As cars become further electrified and advanced, there is a greater need for semiconductors as key devices for functional enhancement. For this reason, advancements in semi-conductor technology and the stable procurement and supply of semiconductors themselves are essential.

With over 50 years of experience in the in-vehicle semiconductor domain, we possess thorough knowledge of both vehicles and semiconductors. Leveraging this distinct advantage, we aim to contribute to the overall semiconductor industry through efforts to comprehensively strengthen everything from the development of advanced semiconductor technologies to the establishment of production structures.

From the perspective of development, we are moving forward with the development of advanced technologies such as gallium nitride semiconductors at the R&D subsidiary MIRISE Technologies Corporation. In addition, through our investment in Rapidus Corporation, a company established to promote the domestic production of advanced semiconductors, we are pursuing miniaturization technology to accelerate the development of semiconductors with a thickness of 2nm or less.

Regarding procurement, we are seeking to realize stable semiconductor procurement through such means as transitioning to alternative parts for components with high procurement-related risks and concluding long-term fixed order contracts with suppliers. Although the tight supply–demand situation for semiconductors as a whole is gradually improving, supply concerns still remain for in-vehicle semiconductors, for which demand is booming. We will therefore take steps to further reinforce our procurement foundation so that we can provide society with as many quality vehicles as possible.

In terms of production and supply, in addition to bolstering our production structure both at our plants and at those of our subsidiaries, we have commenced the mass production of power semiconductors on 300mm wafers in collaboration with United Semiconductor Japan Co., Ltd. We have also invested in Japan Advanced Semiconductor Manufacturing, Inc., a subsidiary of Taiwan Semiconductor Manufacturing Company Limited. In these ways, we are working to secure a more stable semiconductor supply structure through collaboration with various business partners.

Moreover, as part of our efforts to bolster the manufacturing of SiC power semiconductors, we are developing proprietary wafer manufacturing technologies that make use of a so-called gas method. These technologies can reduce CO2 emissions during the manufacturing process by 90% while curtailing costs by 30%.

In the vast field of semiconductors, we will continue to enhance our in-house manufacturing capabilities and pursue strategic collaboration with partners possessing competitive advantages.

E. Promoting Business De-Emphasis and Discontinuation to Enhance Our Overall Competitiveness in the Industry

To achieve an optimized business portfolio, it is important to downsize and/or withdraw from mature businesses in tandem with achieving growth in focus fields.

Although downsizing or withdrawing from a business can be a painful process in the near term, we are promoting Companywide efforts toward de-emphasis and discontinuation in order to pursue the next stage of growth and enhance our overall competitiveness in the industry.

Specifically, we have divided the Company’s businesses into 85 product groups and once a year are determining the future direction of each group based on its contribution to the following criteria: realizing the DENSO Philosophy, accelerating growth, and boosting profitability in terms of ROIC.

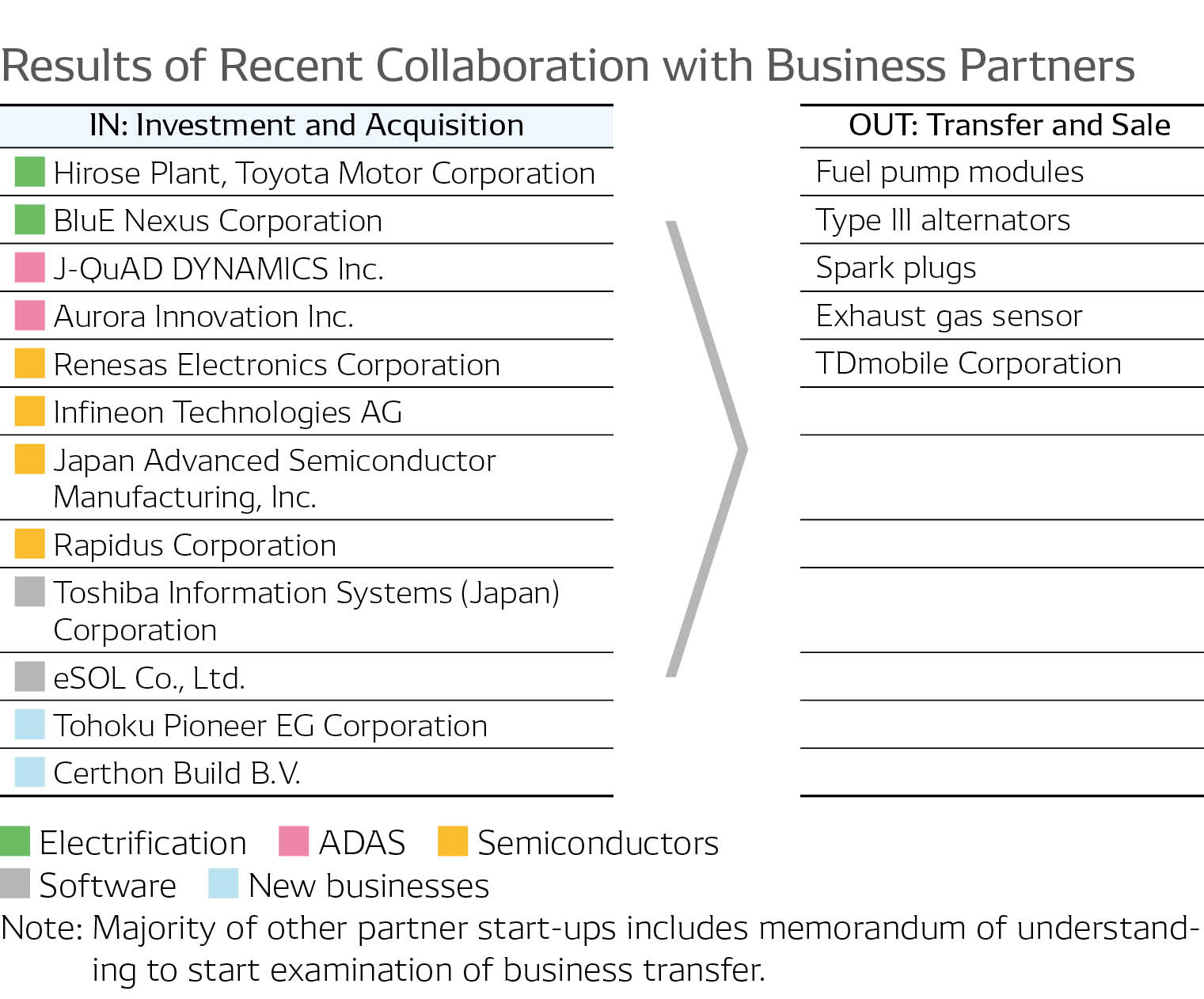

Through these examinations, we transferred our fuel pump module and type III alternator businesses in fiscal 2023 and, in fiscal 2024, we plan on undertaking several other business transfers. For example, we concluded a memorandum of understanding with Niterra Co., Ltd. regarding the transfer of our spark plug and exhaust gas sensor business. These are core products for internal combustion engines that have underpinned our growth thus far and currently contribute to profits. However, in light of our ambition to enter a new stage of growth and fully realize the DENSO Philosophy, we have decided to pass the business on to the company that can handle it best.

For businesses that we transfer to third parties, we leverage the elemental technologies and know-how we have cultivated in such businesses in future growth fields, having them serve as a foundation for new corporate value creation.

Alongside the reshuffling of our business portfolio, we are promoting structural reforms aimed at optimizing our production and supply structure in each region. In North America, we are shifting production to a subsidiary in Mexico, where production costs are low, and consolidating other plants in the region. In Asia, we have liquidated a South Korea-based subsidiary. In these ways, we are promoting the consolidation of our subsidiaries across the globe.

The resources generated from de-emphasizing and discontinuing businesses and from optimizing our production and supply structure will be shifted to bold investments in growth domains.

F. Creating New Value That Connects the Movements of Society

We have held examinations regarding the social trends we expect to see in 2035, using the megatrends anticipated for 2050 as our starting point and back-casting from there. Based on these examinations, we have declared our intention to create a cycle of joy that provides social value by invigorating and forming connections between the flow of five essential elements to keep society in motion: people, goods, energy, resources, and data. Guided by this aim, we will draw on the strengths we cultivated in the field of mobility to pursue the resolution of new social issues and the creation of new value through new businesses that extend our value provision across society as a whole.

(3) Flexibly Responding to Changes and Risks in the External Operating Environment

In concert with realizing growth through the reshuffling of our business portfolio, we are moving forward with reforms to our profit structure to enable a flexible response to risks.

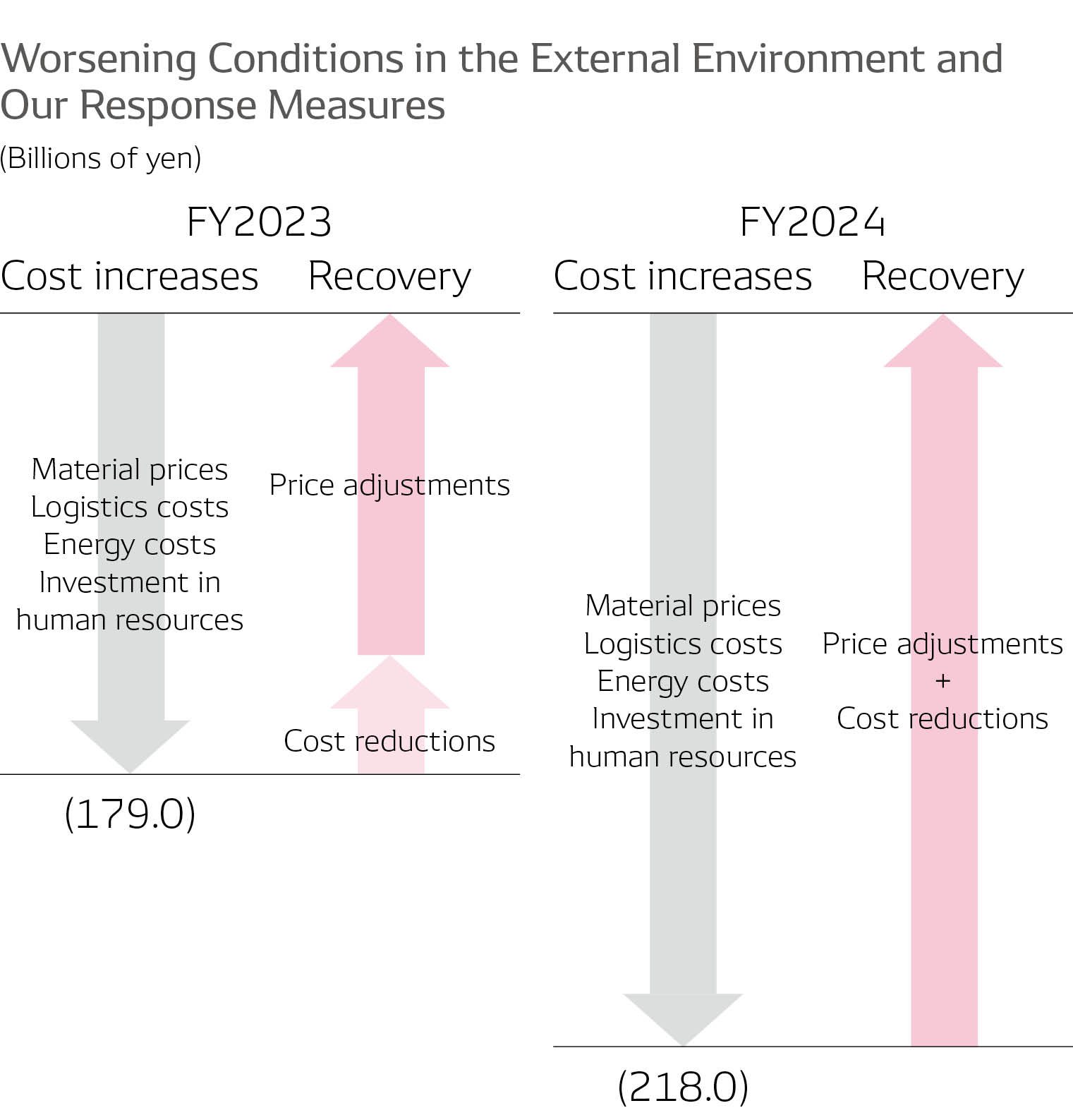

In fiscal 2023, we focused our efforts on reinforcing our ability to respond to change. To address the issue of rising costs, starting with soaring prices for materials, primarily electronic components, logistics costs, and energy costs, brought about by changes in the external environment, we promoted cost-cutting initiatives and sought to transfer costs to customers. As a result, we were able to offset nearly all of the negative impacts of cost increases on profits, which amounted to ¥179.0 billion.

In fiscal 2024, we expect cost increases to have a roughly \218.0 billion impact on profits compared with periods of less volatility, against the backdrop of our accelerated investment in human resources, which includes factors such as inflation and increasing salaries following tight recruiting conditions. However, we will seek to offset this entire amount by stepping up efforts to reduce costs and transfer costs to customers.

Furthermore, through efforts to offset this negative impact, we will establish rules for appropriately reflecting costs through-out the entire supply chain. By doing so, we will help enhance the competitiveness of the automotive industry and realize a circular economy.

First, we will pay the increased prices of our suppliers, taking into consideration the impact of rising material prices, increased energy costs, and higher employee salaries on their operations. We will then reflect these increased costs in our transactions with car manufacturers, thoroughly explaining to them the reasons for price increases using data and other evidence. In this way, we will promote a cycle of appropriate price adjustments, including for end-users.

In addition to these efforts to strengthen our ability to respond to change, which focus primarily on realizing a recovery in profits from the current adverse conditions in the operating environment, we are undertaking reforms to our business model to address changes that will occur over the medium to long term. One major example of such efforts is receiving payments from customers during the stage of software development, as this development itself is becoming far more massive in scale. This does not simply mean that we move the billing period forward, but rather that we ask our customers to clearly recognize the intangible value created through software development, in addition to the more conventional tangible value we create through our hardware. I therefore believe that this effort will help spur a significant change in the awareness of our customers.

Through these means, not only will we provide value to our customers through our advanced technological capabilities, we will also focus efforts on promoting the appeal of the value we offer so that it is appropriately recognized by our customers, which in turn will enhance our competitiveness.

(4) Strategically Investing in Future Growth

A. Capital Expenditures and R&D Expenditure—Striking a Balance between Curtailing Costs and Executing Growth Investments

For a company such as DENSO, which boasts strengths in Monozukuri and R&D, capital expenditures and R&D expenditure are necessary upfront investments for the future. In recent years, we have significantly changed the ways we invest in both areas.

It is important to consider two perspectives when executing upfront investments amid the rapid changes occurring in the external operating environment: accelerating growth by establishing core strengths and curtailing fixed costs in consideration of risks related to such changes.

Looking back on the past five years, we have executed capital expenditures, including toward internal combustion engines, at a level that far exceeded depreciation. Recently, however, with the further entrenchment of ROIC-minded management and the progression of business portfolio reshuffling, we have been curtailing capital expenditures at around ¥350.0 billion, which is nearly the same as depreciation, by winding down our investment in internal combustion engines while continuing to actively invest in focus fields. From the perspective of controlling fixed costs over the medium to long term, we will engage in highly efficient investment decision-making while maintaining our current level of capital expenditures.

We have continued to bolster R&D expenditure, without reduction, even amid the dramatic changes in the external operating environment. In particular, we have invested heavily in software development, starting with the domain of next- generation advanced driver assistance systems (ADAS), and these investments account for more than half of our total R&D expenditure. We have also been striving to improve profitability by promoting more efficient operations through AI and other types of digital transformation and by transforming our business model in the ways I described earlier.

Going forward, we will continue to strengthen R&D expenditure as the bedrock of our competitiveness. However, we will target a level of ¥450.0 billion (including returns) for this expenditure as we further accelerate our efforts toward enhancing efficiency and transforming our business model. By doing so, we will achieve an even greater competitive edge.

B. Accelerating Growth by Strengthening Strategic Partnerships

Although we have been reinforcing the in-house manufacturing of core technologies, collaboration with external partners is indispensable, in terms of both specialization and speed, as changes in the external environment become more intense and customer needs become increasingly more complex.

We have established electrification, ADAS, software, semiconductors, and new businesses as focus areas and have assembled cross-organizational task forces for each area. These task forces are stepping up efforts to examine strategies in their specific area. While we have been promoting collaboration with external partners in each of these focus areas for quite some time, we are working to swiftly narrow down candidates for collaboration that have the necessary means to help us realize our strategies. Through this approach, we will strengthen collaboration with our partners without missing out on important opportunities.

2. Reduce Low-Profit Assets: Improving Asset Efficiency by Reducing Assets While Determining Ideal Asset Levels

DENSO seeks to utilize its asset portfolio with the greatest levels of efficiency by determining the necessary levels of certain types of assets in order to downsize asset amounts.

(1) Optimizing Cash on Hand

We have been working to optimize cash on hand by minimizing the funds needed for business operation (standard business funds) and reducing uneven asset distribution by region through the use of the Global Cash Management System (GCMS). By enhancing the precision of our day-to-day cash management in fiscal 2023, we were essentially able to achieve the fiscal 2026 target for cash on hand of 1.0 times* the amount of monthly revenue for the total of standard business funds and rainy-day funds for emergency circumstances. Going forward, we will continue to promote the efficient utilization of cash as we seek to grow.

* In the financial statements, funds under the GCMS are treated as deposits by the lending company and loans by the borrowing company, which means that they are recorded as both deposits and loans. However, the figure for actual cash on hand excludes the impact of the GCMS.

(2) Curtailing Cross-Shareholdings

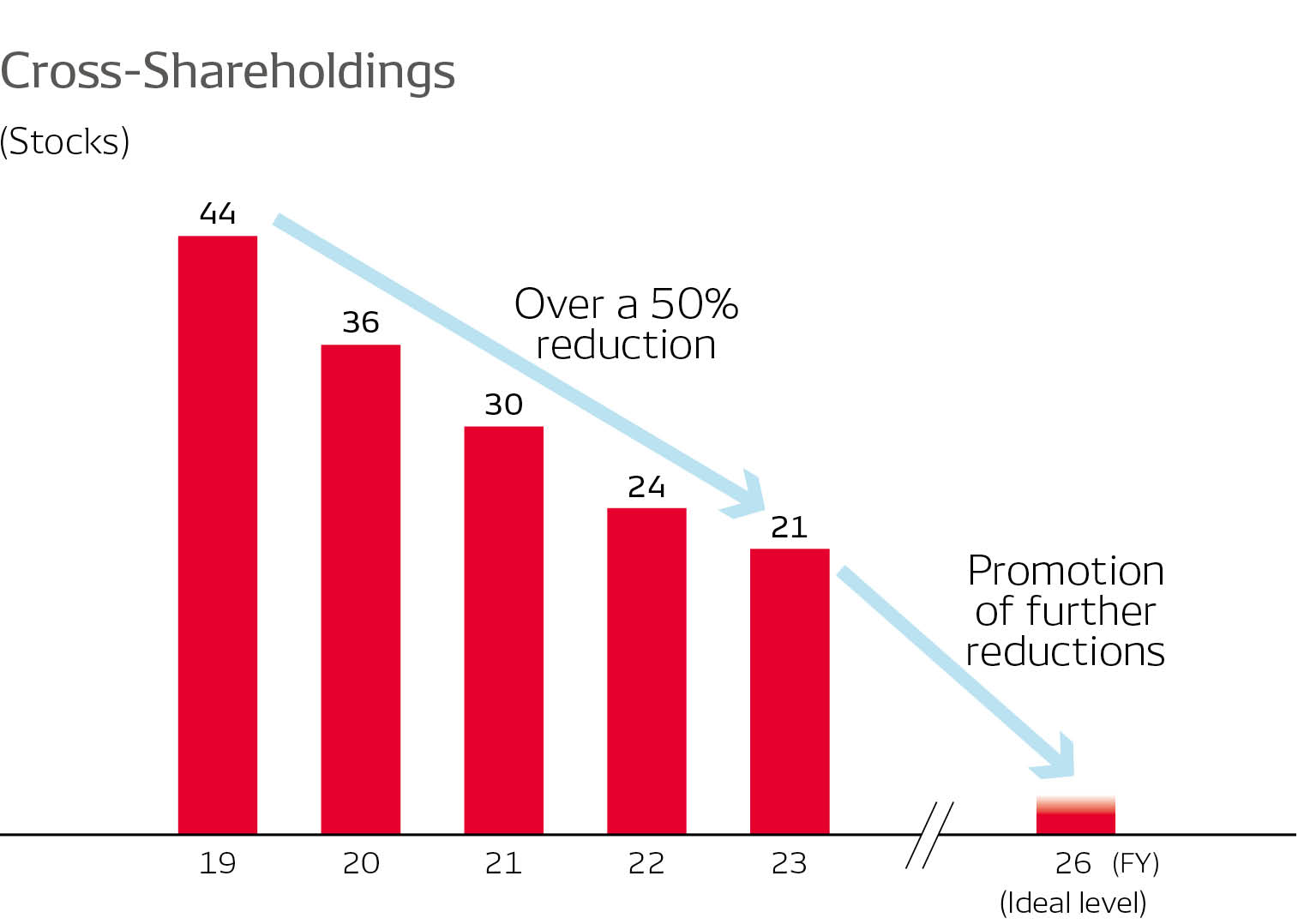

We have decided to widen the scope of cross-shareholdings for which we are examining possible curtailment to include not only shares held by the Company but also those of subsidiaries. By doing so, we are promoting reductions that exceed the requirements of Japan’s Corporate Governance Code. In fiscal 2023, we sold approximately ¥44.2 billion worth of holdings by the Company through total or partial sale of holdings of seven companies. As a result, the total number of cross-shareholdings came to 21, a reduction of over half from the 44 cross-shareholdings owned as of the end of fiscal 2019. Going forward, we will continue to curtail such holdings so that the cash generated through the sales of holdings can be used to invest in creating corporate value as dictated by our growth strategies.

(3) Optimizing Inventories

We have broken down inventories into the three categories of temporary inventories, strategic inventories, and standard inventories, and track each accordingly. Temporary inventories refer to those held in response to logistics disruptions and other external factors. Strategic inventories are those held to hedge against natural disasters and various other risks. Standard inventories are those held for use in production activities under normal circumstances.

In fiscal 2023, inventories amounted to around ¥1.1 trillion as the result of our efforts to secure temporary and strategic inventories in order to ensure a stable supply to customers. In fiscal 2024, we will engage in activities to strengthen our corporate structure on a global basis, working toward inventory levels of around ¥0.9 trillion after revising inventory criteria in a timely manner and reducing temporary inventories to zero in light of the current recovery from semiconductor shortages and easing of logistics disruptions.

Moving forward, we will swiftly identify relevant inventory issues and make concerted efforts toward optimizing inventory levels, thereby further cementing our operating foundations.

3. Improve Capital Structure: Pursuing Targeted Capital Structure by Bolstering Funding Platform and Issuing Proactive Shareholder Returns

We seek to reduce capital costs while maintaining a balance between safety and efficiency, and to utilize borrowings, diversify funding sources, and issue proactive shareholder returns in order to create corporate value. In these ways, we will improve our capital structure.

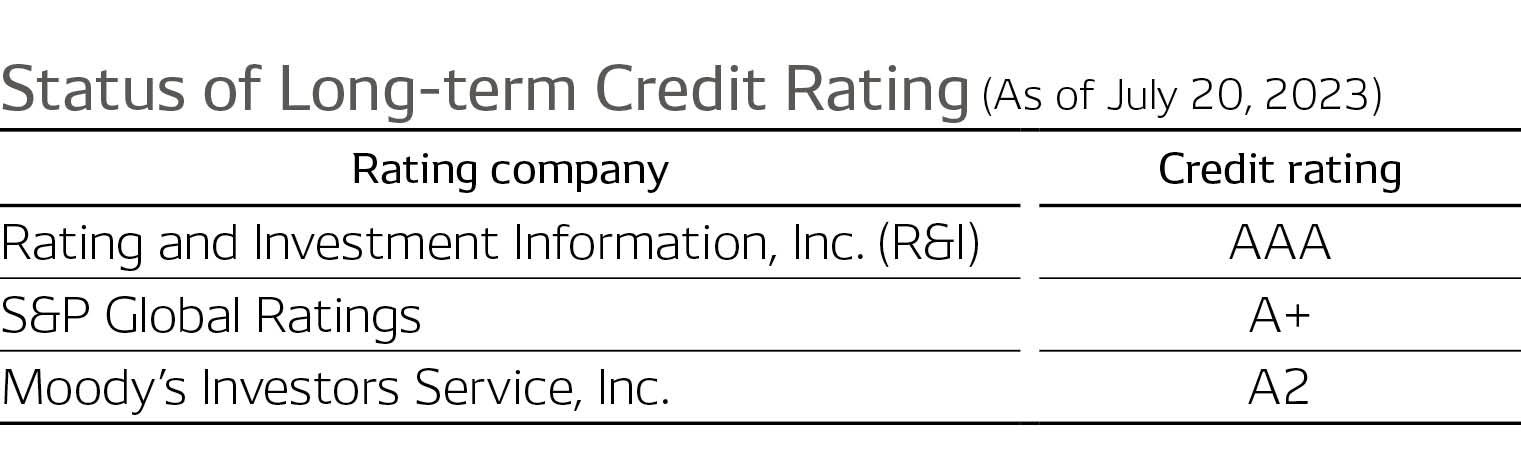

For fiscal 2026, we target a shareholders’ equity ratio of 50% or more. We believe that this is a level that will allow us to maintain a credit score that enables fundraising even during an economic crisis.

(1) Diversifying Funding Sources and Utilizing Borrowings

DENSO prepares for future large-scale investments by diversifying funding sources through such means as utilizing bank loans, domestic corporate bonds, and foreign-denominated funds via overseas corporate bonds. Through such efforts, we are able to raise a large amount of funds from a broad range of investors, which in turn will help us maintain a stable funding platform enabling investment in growth fields and new businesses and participation in M&A activities and business alliances.

Additionally, through the ongoing utilization of sustainability bonds, we will further accelerate efforts to resolve environmental and social issues, centered on the sustainability management initiatives that we have been implementing since our founding.

Going forward, we will seek to further improve capital efficiency by actively utilizing borrowings and bonds while main-taining a high degree of financial health.

(2) Shareholder Return Policy

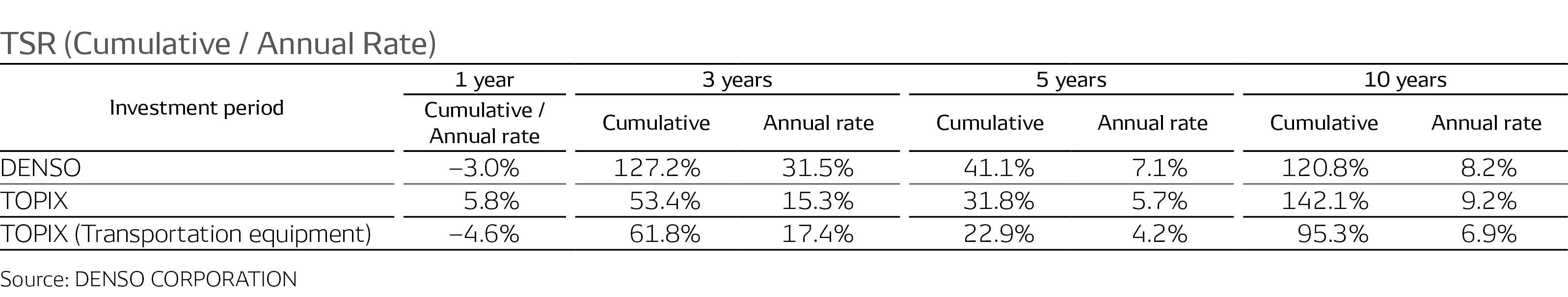

DENSO aims to realize and further enhance total shareholder return (TSR)* that exceeds the cost of shareholders’ equity steadily over the long term by increasing both dividends (income gain) and share price (capital gain).

For dividends, we have adopted a basic policy of consistently growing dividend on equity (DOE: Dividends ÷ Shareholders’ equity) using the level of 3.0% as our baseline. Guided by this policy, we increased DOE by 0.1 percentage point year on year in fiscal 2023, to 3.2%. As for treasury stock acquisition, we acquired ¥100.0 billion in treasury stock in fiscal 2023, up ¥2.5 billion year on year. The scale of this acquisition was determined by comparing our targeted capital structure and theoretical share price with actual figures based on our long-term business plan. Looking ahead, we will continue to promote the flexible acquisition of treasury stock while expanding the scale of this acquisition.

Through our efforts to enhance stable, long-term shareholder returns, we will realize TSR that exceeds the cost of shareholders’ equity. At the same time, we will curtail increases in capital and enhance our corporate value.

*TSR: Total return on investment that combines capital gains and dividends

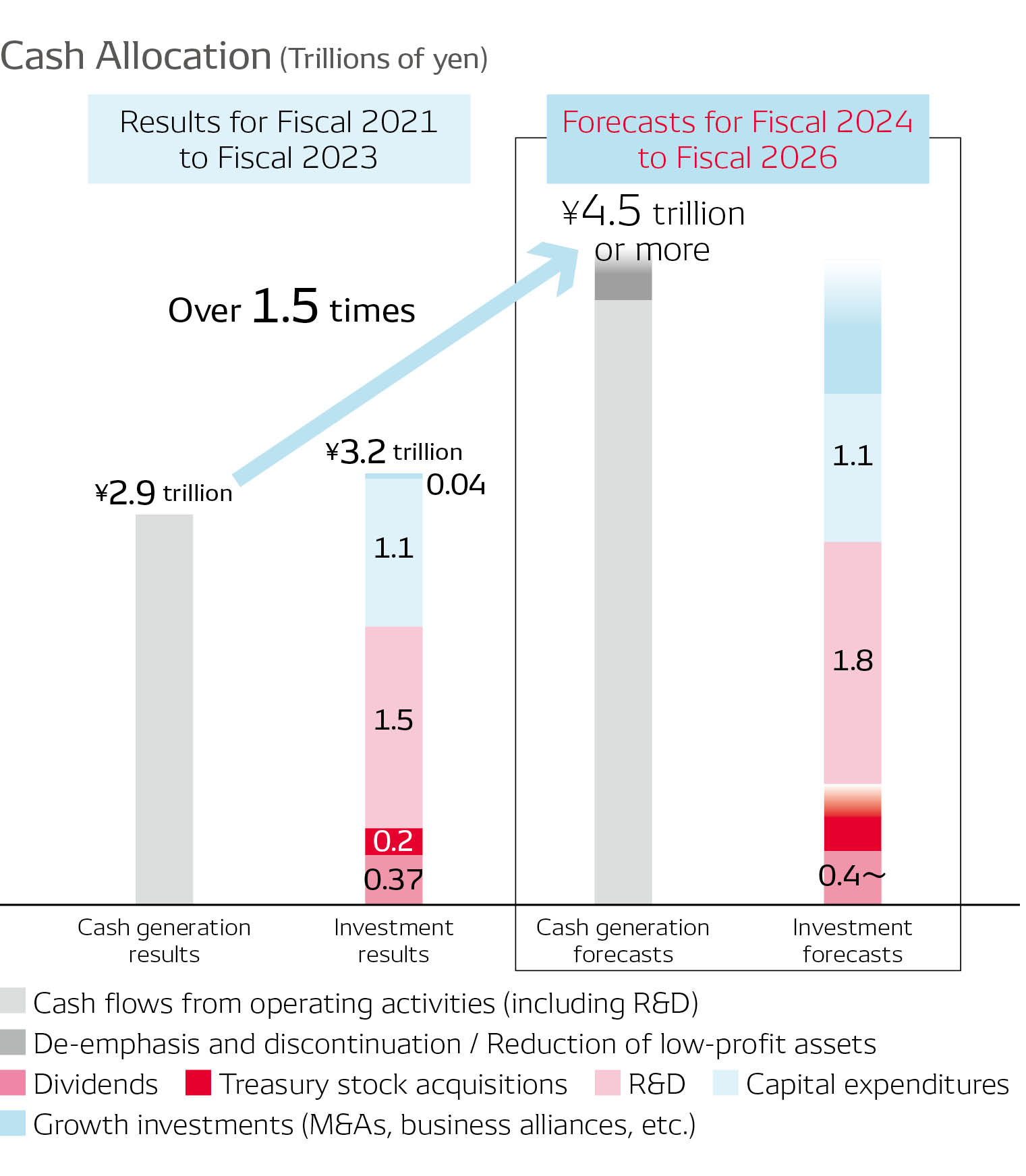

(3) Cash Allocation

DENSO has steadily reinforced its profit structure through ROIC-minded management. As a result, we have generated a total of \2.9 trillion in cash flows from operating activities over the three-year period from fiscal 2021 to fiscal 2023, even amid the COVID-19 pandemic and a worsening external operating environment, including semiconductor shortages. Over the next three-year period starting from fiscal 2024, we will aim to generate \4.5 trillion or more in cash through the further reshuffling of our business portfolio and reduction of low-profit assets.

Meanwhile, we will seek to enhance investment efficiency by

thoroughly examining capital expenditure projects, striving to maintain these expenditures at around the same level as depreciation in a highly disciplined manner. For R&D expenditure, we will step up software development, primarily for ADAS, as soft-ware becomes more deeply integrated into our products.

With a view to fiscal 2026, we also believe that growth investments such as M&As and business alliances, in addition to in-house manufacturing, are essential to the growth of our businesses and the realization of the DENSO Philosophy. To that end, we will proactively utilize borrowings to implement large-scale investments, as needed, in an effort to achieve business growth and improve our capital structure.

We will also seek to strengthen stable, long-term shareholder returns through continuous increases in dividend levels and the proactive acquisition of treasury stock.

Through these initiatives, we will strive to maximize ROE and enhance corporate value on an ongoing basis.

4. Engage in Dialogue with Markets: Increasing Communication Regarding Our Long-cultivated Non-financial Capital and Promoting the Appeal of Our Value Provision

DENSO is communicating information to investors and analysts in a timely and appropriate manner and advancing dialogue through efforts by corporate officers. Through these activities, we aim to reduce information gaps with capital markets and expand our equity spread by reducing the cost of shareholders’ equity.

In fiscal 2023, we created opportunities for dialogue, including arranging online meetings, with an aggregate total of 1,500 companies, an increase of approximately 1.5 times compared with the previous fiscal year, amid ongoing restrictions on communication with investors imposed by the COVID-19 pandemic. We communicated the opinions received through these dialogues at meetings of the Board of Directors and other official inhouse organizations. We also worked to deepen investor understanding of our operations by incorporating these opinions in DENSO DIALOG DAY 2022 activities and a briefing session on our semiconductor strategy.

Moreover, we are ramping up initiatives from an ESG perspective, centered on our sustainability management, in light of the increasing attention being turned toward ESG investment. In addition to reducing business risks over the medium to long term, these initiatives will lead to an increase in the number of business opportunities for the Company.

For example, as human capital, intellectual capital, and other forms of nonfinancial capital have been garnering greater attention, we have been swiftly moving forward with investments in intangible assets, including those aimed at Hitozukuri (the development of human resources) and R&D, based on the belief that such forward-looking investments will translate directly to corporate growth. There is no denying that investments in intangible assets have been integral to DENSO’s ability to continuously provide value that preemptively addresses the needs of the times. We therefore recognize that nonfinancial capital will be a key factor underpinning our competitiveness over the medium to long term. Based on this recognition, we are ramping up forward-looking investment in non-financial capital.

Furthermore, we believe that communicating ESG information helps clear up any uncertainty regarding the future and helps reduce the cost of shareholders’ equity. We therefore are working to quantify the benefits of investment in non-financial capital and clarify how such investment contributes to corporate value. This effort is an important element in ensuring that stakeholders accurately evaluate our growth potential. As an effort in this regard, in DENSO Integrated Report 2023, we have summarized the relationship between non-financial capital and financial value and introduced our individual capital strategies with a focus on this relationship.

In fiscal 2023, we received a second-place ranking in the Automobiles/Parts/Tires division of the 2022 Award for Excellence in Corporate Disclosure, in recognition of our IR activities. Furthermore, DENSO Integrated Report 2022 received the Silver Award for excellence of the WICI Japan Integrated Report Award 2022, marking the second consecutive year our report has received this award. In these ways, our IR activities and stance on information disclosure have been highly evaluated by numerous institutions.

Additionally, we are working to enhance employee awareness of corporate value by actively utilizing our integrated report in-house. Moving ahead, we will reflect the various opinions we receive through dialogue with markets in our efforts to enhance the quality of our management.

TOPIC: Establishing Environments for Facilitating Investment in the Company

As of September 30, 2023, the shares of common stock owned by shareholders will be split into four shares for every one share held. Through this stock split, we will lower the minimum amount required for investment, thereby making it easier for a broader range of investors to invest in DENSO stock.

Closing

Over the past several years, we have continued to deal with an adverse operating environment, including the COVID-19 pandemic, semiconductor shortages, and the global surge in raw material prices. However, by continuing to earnestly pursue our goals amid such adversity, we believe we can become an organization that can provide value that preemptively addresses the needs of the times. Guided by this belief, we sought on a Groupwide basis to reinforce our profit structure. As a result, in fiscal 2023 we achieved record-high operating profit for the first time in five years.

To continue to create corporate value moving forward, we will remain committed to aggressively promoting our financial strategies. In addition, drawing on the CASE domain and new businesses as growth drivers, I would like to promise the success of our efforts to de-emphasize and discontinue mature businesses and further accelerate the creation of corporate value. I am sure that these efforts will allow us to show you an even stronger DENSO. We ask that you look forward in anticipation as we pursue these endeavors.